CORONAVIRUS DROPS 2020 VIETNAM CONSUMER CONFIDENCE BY 54 POINTS

Huge down turn on many domestic sectors expected

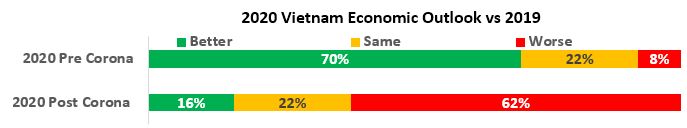

Prior to the outbreak for the Coronavirus in China, Vietnam’s consumer sentiment for 2020 stood at 70% of consumers seeing Vietnam’s economy being better than in 2019. Four weeks Later in a survey of the same consumers, less than 20% were upbeat about Vietnam economic health, with 62% stating Vietnam’s economy would be worse in 2020 than in 2019, as per Infocus Mekong Research Survey of over 7,000 consumers in Vietnam, released on February 20, at The Cancham Crystal ball Luncheon.

“The turnaround in sentiment has been unprecedented” noted, Ralf Matthaes, Managing Director of Infocus Mekong Research, the surveys Provider. “Even the SARS outbreak in 2003, can best be described as only a blip on Vietnam’s Consumer Confidence radar”, he added.

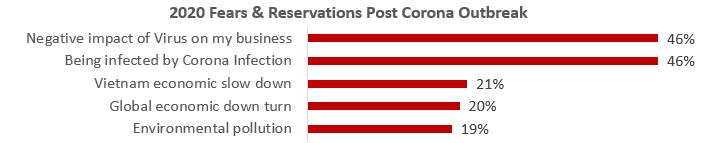

Prior to the outbreak, Vietnamese consumer biggest fears and reservations concerning 2020 were Environmental pollution (53%), the reduction of Healthcare / Education services and Infrastructure development in the country. Now consumer fears are completely focused on being Infected by Corona and its negative Business impact.

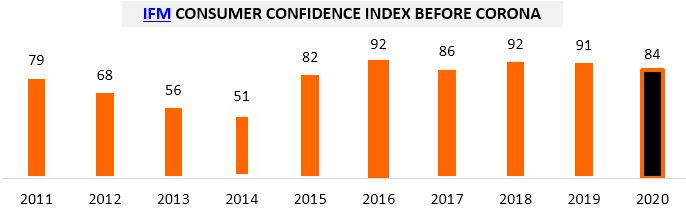

Prior to the Corona outbreak, Vietnamese Consumers were optimistic about 2020. The IFM Consumer Index showed a drop in overall confidence, but not significantly, from 91 in 2019 to 84 Index points in 2020.

Part of the drop can be attributed to 2020 being the “Year of the RAT” in the Zodiac, a year underpinned by timidity, conservativism and above all caution. These beliefs should not be under estimated, considering roughly 60% of South Vietnam’s population is Buddhist and the North, though non -denominational, is guided by Confucian precepts, hence impacting behavior.

Other impacting factors revolve around Vietnamese consumers changing psychological - emotional and functional needs. Today’s consumers are all about experience and wanting larger ticket items such as Overseas Holidays, Michelin restaurant experiences and above all cars, as witnessed by the huge growth of both Car sales, transportation spend and Car loans witnesses on 2019.

Index: The index is based on 11 Consumer spend categories in terms of spending more – same – less than previous year. More + Same subtract less of 11 categories average = Index

Reduced spend Sectors

Education, Food & Beverages, Healthcare and Personal care remain the top spending categories for 2020. However, the growth of these categories spend seems to be in decline, especially for all forums of communications, with the advent of Viber / What’s App, Zalo Chat, digging into communications revenues and 90% of the Vietnam population above 18 owning smartphones, even Thế Giới Di Động (Mobile World) is resorting to selling watches to stem the bleeding.

It is important to note that not every sector will be impacted the same, but some certainly more than others. “Early indications suggest the Hotel/ Hospitality, Retail, F&B and Manufacturing/Logistics sectors are among the hardest hit, some of our clients are reporting trading performance down between 20-50% depending on the sector and location. It remains to be seen how severe and how long the virus lasts, real estate developers that are already highly leveraged may need to find additional funding or consider JV partners or selling assets. History suggests that after similar events, business confidence rebounds quickly, resulting in a positive impact on the market.” Noted Stephen Wyatt – Country Head – JLL Vietnam.

Almost all entertainment activities shall also suffer significantly in 2020, from Travel / Tourism and hospitality, restaurants, bars, Cinemas, as Vietnamese consumer avoid public places.

However, due to the Corona Health scare fears, Healthcare and Personal care products, could see a positive rebound as consumers protect their families from Infection.

| SECTOR SPEND – MORE – SAME – LESS | |

| SPENDING 2020 | Vs 2019 |

| Education | -9% |

| Home appliances | -10% |

| Health care products/services | -13% |

| Personal care products | -16% |

| Entertainment & dining out | -19% |

| Communications | -21% |

Finally, we should also see a decline on personal loans. In 2019, 54% of those surveyed took out some form of loan from either a bank, consumer credit institution or from other non – institutional sources, only a growth of 2% vs. 2018. Considering the cautious sentiment in the year of the rat, this may well decline in 2020.

The big winners in 2020 shall be On-line Shopping / Delivery services, the Automotive industry, Packaged Foods and potentially, homecare products as consumers spend more time at home and less time in public places.

Increased Spend Sectors

The big winners in 2020 shall be On-line Shopping / Delivery services, the Automotive industry, Packaged Foods and potentially, homecare products as consumers spend more time at home and less time in public places.

Though On-line shopping only represents roughly 5% of the total retail value in 2019, today 76% of all consumer have purchased on-line in the past three months and growth rates are above 20% annually. Added Tom Peng, CEO of Mediastep “When many industries are weathering the impact of Coronavirus and some put into temporary stagnation, the digital economy may help with hedging economic risks and uncertainty. While people are avoiding going outdoors, this may spur more demand in ecommerce and online food delivery services.”

| SECTOR SPEND – MORE – SAME – LESS | |

| SPENDING 2020 | Vs 2019 |

| On-line Shopping / Delivery / Etc. | 20% |

| Transportation | 12% |

| Household utilities | 11% |

| Packaged Food & beverages products | -4% |

| Household care products | -5% |

Forty-seven percent of all consumers noted spending more on Transportation in 2020. In addition, last year was a peak year for car sales and 19% of all those who took out loans, were for car purchases, the Automotive industry stands to continue its rapid growth.

Predictions 2020 – Not all Doom and Gloom

“Historically, Vietnamese are very optimistic people, amongst the top 10 percentile in Asia and are resolute and resourceful. Noted Matthaes, “However, with Public Schools Potentially being shut down till March, creating a huge impact on productivity and Parental burdens and due to the daily Coronavirus warnings, from the Ministry of Health, fear has struck at the hearts of Vietnamese consumers”

Hence, Consumerism growth will be down versus 2019 by an estimated 10% to 15%, predicated by the “Year of the Rat” conservatism and Corona’s negative impact on consumer purchase behavior. Some sectors will be impacted much worse than others, and the end result will not be positive for overall consumption growth in 2020

Positively, Automotive, on-line everything, Packaged Food and Home care should see increased growth, as consumers stay closer to home in 2020.

But as Mr. Bao Nguyen, President of the Canadian Chamber of Commerce Vietnam, succinctly concluded “Life goes on, must go on and will go on. Vietnam continues to have all of its stars aligned, is and remains a fantastic business destination that deserves all the growing attention it is getting around the globe. Growing pains are normal, having doubt is smart, not exploring the opportunities that Vietnam continues to offer is not.”

Managing Director

This email address is being protected from spambots. You need JavaScript enabled to view it.