CORONAVIRUS SLASHES VIETNAM’S BUSINESS CONFIDENCE BY HALF

But Pundits are still optimistic for 2020

On February 20th, Infocus Mekong Research released its Annual 2020 Vietnam Business Community Sentiment / Confidence Index, at the 15th Annual Cancham Crystal Ball luncheon, held in HCMC, Vietnam.

The survey of 242 CEO’s, Managing Director, Business Owners, etc., showed a huge drop in overall business confidence for 2020, compared to last year. This has largely been a result of the Coronavirus, also referred to as COVID19, impact over the past 45 days globally, but specifically in Vietnam. “I have been living in Vietnam for over 26 years and have never seen such a huge plummet in overall confidence, not even during the 2010-2011 Real estate bubble burst.” Noted Ralf Matthaes, Managing Director of Infocus Mekong Research and host of the survey.

2020 ss 2019 Economic Outlook

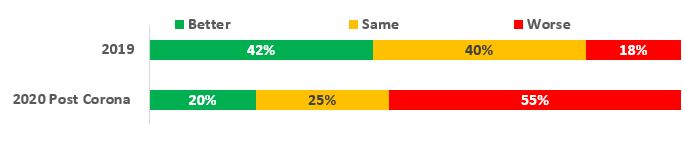

What is your view of the overall economy in 2020 as compared to 2019

2019 was a positive year in Vietnam for business with a 6.5% GDP growth, record growth in Exports, Foreign Direct Investment and controlled inflation at 3.5%. Considering consumer confidence measures in December of 2019 for 2020 were very high, with 70% of consumers perceiving the economy to be better in 2020, assumption would be that Business sentiment follow suite. However, 84% of those surveyed noted the Coronavirus would have a negative impact on their business this year.

However, “It is still early days living with the Corona virus but from a macro perspective its duration will dictate whether we are simply experiencing a blip in macro activity or whether we are at the start of serious and prolonged downtown. As this is a new virus, timings are hard to forecast, but based on SARS and available information on both new cases and actual severity, we would be hopeful that much economic activity will be returning to normal by the end of 2Q20.” Noted Chris Hunt, Manager Director of HSC Vietnam.

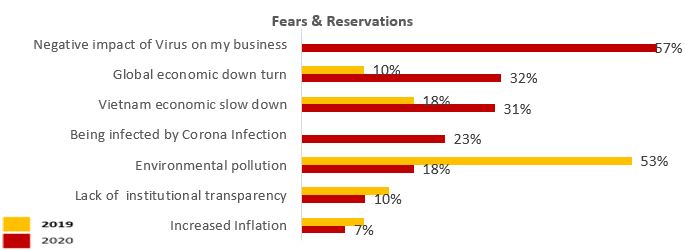

When asked what these C-Suite executives were most concerned about in 2020, the impact of the Coronavirus on their business, as well as Global and Vietnam economic slowdown, were dominating concerns, compared to one year ago, where the environment was the number one concern.

It is important to note that not every sector will be impacted the same, but some certainly more than others. “Early indications suggest the Hotel/ Hospitality, Retail, F&B and Manufacturing/Logistics sectors are among the hardest hit, some of our clients are reporting trading performance down between 20-50% depending on the sector and location. It remains to be seen how severe and how long the virus lasts, real estate developers that are already highly leveraged may need to find additional funding or consider JV partners or selling assets. History suggests that after similar events, business confidence rebounds quickly, resulting in a positive impact on the market.” Noted Stephen Wyatt – Country Head – JLL Vietnam.

style="text-align: justify;">Businesses with heavy reliance on China will obviously feel the impact and many severely. Frederick Burke, Managing Partner of Baker Mckenzie and a veteran of WTO Accession and Bilateral Trade in Vietnam explains “In terms of Vietnam's overall economic development strategy, it's "steady as she goes" with the country's drive to integrate into the global economy by means of bilateral and multilateral free trade agreements, will continue to create new opportunities for trade and investment over the coming years. In the short term, however, 2020 will see challenges for many businesses that may not be strong enough to withstand the shocks to the supply chain and credit availability that we're starting to see. The tourism industry was the first to feel it, but even manufacturing for export is starting to feel the pain as imported components from China are getting held up in China's shut down. Resiliency in supply chains has already become a theme and now it's front and center.”

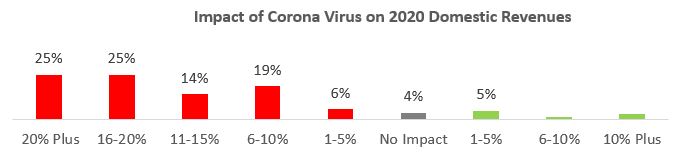

When looking at Vietnam’s domestic services, from advertising to Zoo’s, Vietnam’s local economy will feel the pinch. >With the recent announcement that Public schools may be closed till the end of March, will have a huge impact on productivity and Parental burdens. Add to this, the daily Coronavirus warnings from the Ministry of Health, fear has struck at the hearts of Vietnamese consumers, reducing overall traffic flow and deadening demand. When asked what impact the Coronavirus will have on their domestic revenue streams for 2020, an average revenue loss versus budget was pegged at -13.48%

Silver Lining

All is not doom and gloom though. The big winners in 2020 shall be On-line Shopping / Delivery services, the Automotive industry, Packaged Foods and potentially, homecare products, as consumers spend more time at home and less time in public places.

Though On-line shopping only represents roughly 5% of the total retail value in 2019, today 76% of all consumer have purchased on-line in the past three month and growth rates are above 20% annually. With Corona impacting shopping behavior, by consumers wishing to avoid crowds, On-line services shall continue to grow and also recruit new customers to their services.

Forty-seven percent of all consumers noted spending more on Transportation in 2019. Furthermore, last year was a peak year for car sales and 19% of all those who took out loans, we for car purchases, it stands to reason that the Automotive industry continues its rapid growth.

Investor Opportunities

In terms of Investor sentiment and the stock market, the Coronavirus actually provides ample opportunity. “Investors are looking for a reason to be “risk-on”. There is a sense of over caution and thus, the VN stock markets have not had to endure a significant decline. But as soon as a major economy such as China announces that COVID19 is under control, we expect capital markets around the world including Vietnam to recover and possibly surpass levels seen at year end 2019.” Said Andy An Ho, Managing Director / Chief Investment Officer of VinaCapital.

“2020 will certainly dampen short term gains for Vietnam, specifically in the consumer-based sectors, as consumers proceed with caution in the year of the rat. However, as one of the most optimistic, resourceful and resilient peoples in Asia, this should only be a blip on Vietnam’s overall economic trajectory.” added Matthaes. “Corona will not derail Vietnam’s amazing rise to the top of the Asian economic food chain”.

Mr. Bao Nguyen, President of the Canadian Chamber of Commerce Vietnam, succinctly concluded “Life goes on, must go on and will go on. Vietnam continues to have all of its stars aligned, is and remains a fantastic business destination that deserves all the growing attention it is getting around the globe. Growing pains are normal, having doubt is smart, not exploring the opportunities that Vietnam continues to offer is not.”

Managing Director

This email address is being protected from spambots. You need JavaScript enabled to view it.