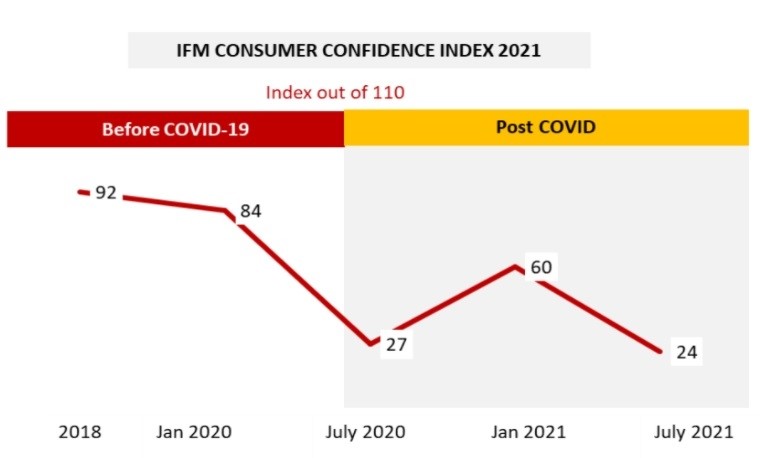

Consumer confidence has hit a record low due to the resurgence of COVID-19 cases in Ho Chi Minh City and neighbouring provinces.

The fourth wave of the COVID-19 pandemic has had the greatest effect on consumer confidence. Photo: Le Toan

According to the latest survey by Infocus Mekong Research, the fourth wave of the COVID-19 pandemic is causing havoc on earning power across Vietnam. 10 per cent of those surveyed have lost their jobs in the past six months or are still unemployed since COVID-19 struck Vietnam. Four out of ten respondents are working part-time or on reduced salary.

Fear of infection has reached an all-time high followed by negative impact on business and fears of unemployment have risen to 50 per cent.

Consumer confidence has plummeted to a 25 year low at 24, even lower than during the first wave. Consumers are addressing their fears by a huge decline in spending.

Every category measured has seen a steep decline in consumption spend, with only utilities spend seeing an increase as consumers lock themselves in at home. Entertainment- dining out, transportation, and home appliance categories will see the biggest negative sales impact.

Any behaviour which costs money is in decline. Being home-bound is the present norm. As a whole, consumer behaviour is being driven by reducing costs, spending less, and weathering the present pandemic storm. Essentially, behaviour is driven by tightening budgets everywhere.

Hardest-hit will be gyms and any paid-for exercise schemes. Any activity that provided entertainment, convenience, and safety in the home should experience a boon.

The stay-at-home trend also leads to retail consumption shifts. Among them, e-commerce will experience significant growth in the next few months, with 44 per cent noting using e-commerce more. Online, seen as safe, cost-friendly, and a convenient channel, will continue to thrive. It is forecasted that new entrants and traditional brick-and-mortar retailers will join the trend and price wars will break-out.

Convenience stores at a growth rate of -1 per cent will continue to do well during the next few months, due to their base offer, convenience, and reach. Look for extended hours and new service offers.

All other retail formats shall experience a decline in both usage and sales. Wet markets and mom and pop stores are less affected due to their lower price points and retailer/customer long term relationships. Supermarkets due to their large size and perceived higher price points will suffer more, as customers tighten their wallets and avoid larger areas with high traffic flow.

In addition, the survey shows that 90 per cent of consumers follow government COVID-19 protocols and 78 per cent acknowledge that Vietnam has done well in COVID-19 protection. 84 per cent of Vietnamese are eager to receive a vaccination, with 12 per cent undecided and 4 per cent unlikely to accept vaccinations.

For those who are undecided, the key rationale is negative symptoms such as blood clotting, lack of trust of manufactures, and lack of knowledge of the source of origin.

By Infocus Mekong Research

The fourth wave of the COVID-19 pandemic has had the greatest effect on consumer confidence. Photo: Le Toan